Mary C. DeLai, President, District Resources Group LLC

On January 22, Governor Baker released the first draft of the FY2021 state budget requesting an appropriation of $44.6 billion, a 2.3% increase over the FY2020 approved budget. This budget proposal was predicated on a consensus revenue amount of $31.15 billion which assumes 2.8% growth in total tax collections over FY2020 estimates. It also assumes that the income tax rate decreases to 5% as of January 1, 2020. By all accounts, state finances had finally fully recovered from the lean post-great recession years. Even the state’s “rainy day” fund had an unprecedented balance of $3.5 billion, nearly recovering to the reserve to actual ratio of 9% seen just before the economic crash of 2008.

Just two days prior, on January 20, 2020, the first case of the novel coronavirus was reported in Washington state. Eleven days later, on February 1st, the first case was detected in Massachusetts. A month later, cases in Massachusetts were increasing rapidly and by March 10, Governor Baker was declaring a state of emergency. On March 13, the Boston Marathon was postponed from April to September. And on March 15, Governor Baker ordered all public and private schools in Massachusetts to close effective March 17 – April 7; that order was extended to May 4th on March 25th, just two days after he issued a statewide stay-at-home advisory. On April 21st, the Governor announced that schools would not return to in-person learning for the remainder of the school year. A head spinning turn of events all unfolding over the course of just 90 days.

Between March 6 and March 27, 2020, three major pieces of federal legislation were passed to provide coronavirus related relief to the nation including:

- Coronavirus Preparedness and Response Supplemental Appropriation Act, passed on March 6, 2020. Funds vaccine research and development, as well as medical infrastructure expenses and supplies necessary to fight the virus.

- Total appropriation: $8.3 billion

- Funding for Massachusetts state fiscal relief: $0

- Families First Coronavirus Response Act, passed on March 18, 2020. Funds expanded sick leave benefits, food assistance, unemployment benefits, and federal reimbursement for state Medicaid spending.

- Total spending: $192 billion (including $105 billion in tax credits)

- Funding for Massachusetts state fiscal relief: $1.5 billion

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act), passed on March 27, 2020. Funds substantial fiscal assistance for states as well as direct payments to individuals as well as extension of unemployment benefits.

- Total spending: $1.8 trillion

- Total funding for K-12 schools nationally: $13.23 billion

- Funding for Massachusetts state fiscal relief: $1.656 billion (plus $45.7 targeted specifically for childcare)

- Funding for local governments with populations over 500,000 (Boston is the only city in MA to meet this threshold): $1.0 billion

- Fund for Massachusetts K-12 schools: $214.9 million in direct aid distributed based on Title I formula (does not include $51 million for emergency education relief grants at the discretion of the state)

Near the end of April, with the small business relief funding exhausted and the need still great, a fourth coronavirus relief measure was passed on April 24, 2020. This package included additional funding for small and medium size businesses as well as hospitals, and funding for expanded testing nationwide. The total appropriation was $484 billion with no funding targeted for state or K-12 fiscal relief.

The total amount of federal stimulus funding directed to K-12 education in these four stimulus packages is $13.23 billion plus an additional $2.95 billion to be allocated by governors as emergency relief. This $16 billion dollar infusion falls far short of the $115 billion allocated for education relief as part of the 2009 federal stimulus package. In fact, that relief bill allocated $53.6 billion in state aid directly to schools with another $25 billion flowing to schools through Title I and IDEA grant increases.

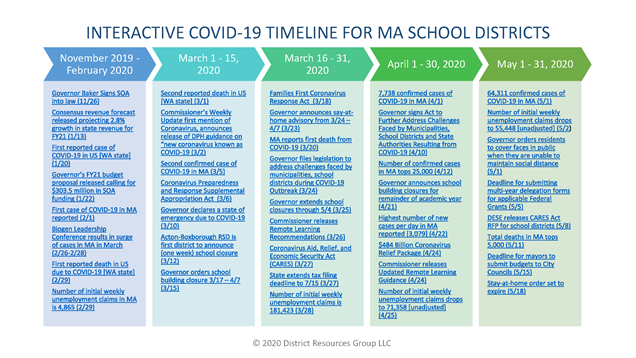

The theme that most resonates with district and school leaders over these past six months – the only constant is change. The graphic below summarizes the major COVID-19 related events impacting school districts over the last six months. An interactive version with embedded hyperlinks to the resource or source document for each event can be downloaded from our website at www.districtresourcesgroup.com.